Learn everything you want to do to get your ex’s identity from the financial on the home while you are staying they on your divorce or separation.

The question of whom provides the house into the a separation try fraught that have difficult financial and you will emotional effects. However, even though you along with your lover keeps agreed which you’ll secure the household-or a legal has actually awarded they to you personally included in the home department in your divorce or separation or courtroom separation-you’re not always carried out with the problem. You will need to eradicate their partner’s name throughout the mortgage. Some tips about what you should know.

As to the reasons Remove Your Ex’s Label Throughout the Financial?

As long as you and your spouse grabbed aside financing together once you purchased your house (otherwise after you refinanced will ultimately via your relationship), the lender enjoys a few resources of payment for the mortgage. Whether or not you altered the brand new term to your domestic (having or in the place of a divorce case) otherwise you have decided that partner won’t become in control into the financial following divorce proceedings, that’ll not affect the financial. Should anyone ever get behind for the house money, the lending company will receive the authority to started immediately following their ex.

This is the major reason you can constantly be required to take the fresh new action out-of deleting your partner’s identity regarding the financial whenever you obtain your family family on the splitting up.

While you are remaining the family house in your divorce or separation, you are able to almost always have to refinance the loan by applying to have another type of financing in your title merely.

Refinancing to place our home in your Title Alone

Mobile identity to your home won’t get wife or husband’s identity out-of the borrowed funds-while you should do one as well (regarding you to definitely less than). While you are staying your family domestic on your splitting up, you are able to more often than not have to re-finance the borrowed funds through the use of to possess an alternate mortgage on your own label just.

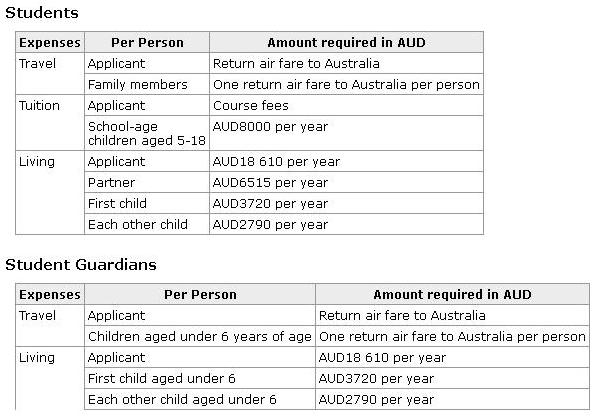

Just as once you originally grabbed from mortgage, you will need to citation the latest lender’s eligibility requirements in order to re-finance the latest mortgage. You’ll want to demonstrate that you’ll be able and work out brand new money and you may meet your own prevent of package. This time around, yet not, the financial institution could be looking here at their property, income, bills, and credit score.

In the event your credit and you may financials are not sufficiently strong enough themselves to help you be eligible for the mortgage you would like, you will need to built other options, such as for example while making a much bigger downpayment, asking someone to cosign the mortgage to you personally, otherwise borrowing from the bank money from nearest and dearest otherwise members of the family.

Needless to say, you should take the requirement for refinancing under consideration if you are settling a home buyout during your separation. So if you’re on the other side stop of a beneficial buyout, you are going to need to make sure your lady enjoys certified having a good re-finance before you could agree to it.

Can you Get rid of The Partner’s Label From the Mortgage Rather than Refinancing?

In the event that interest levels is all the way down once you re-finance than they certainly were once you got the actual new family mortgage, the refinancing could lead to down mortgage payments. Of course, the reverse is valid too: You may be confronted with larger payments if the interest rates was higher once you refinance. When this is the case, you may have another option to get your spouse’s title of the mortgage.

If you can suppose the loan, the financial institution you are going to agree to release your spouse regarding the home loan, you suppose full obligation to the mortgage. But you should know that loan providers won’t do this. As well as if you discover a lender who can invest in launch your lady, you’ll need to demonstrate that Coaling loans you is always improve mortgage payments yourself.

Transferring Title of the house

In addition to removing your spouse about home loan, you’ll need to make certain the brand new label (ownership) of the property was moved to your. Though there vary sorts of interspousal import deeds, you can easily typically explore a beneficial quitclaim deed, and this transfers your own partner’s need for the home for you. (You’ll find and you may download state-specific versions having quitclaim deeds.)

When you re-finance the mortgage, the latest escrow company will usually deal with most of the documentation, together with import regarding deeds will happen at the same time. Your spouse should indication the brand new quitclaim deed at the front end of the financing manager, who will next take your partner’s title off the possessions action while the mortgage.

During divorce proceedings, it’s popular getting process of law to issue requests that will be meant to retain the couple’s economic situation quo before the divorce proceedings is last. In some claims, these types of orders is actually instantly active once both mate files to have divorce proceedings, and they will be added to the divorce or separation petition and other initial documentation. Various other says, a judge will always question the orders when a spouse desires they.

Always named short-term restraining purchases (no matter if they are different than TROs to cease domestic physical violence), these purchases generally speaking ban possibly partner off delivering specific tips having their house (and offering it, transferring it, otherwise credit cash on it) with no other wife or husband’s concur or a court’s order.

As a result your elizabeth off the deed to your home unilaterally-at least maybe not until you signed a binding agreement that enables one, a court features granted an order making it possible for the change, or the divorce case try last. Cautiously take a look at all the papers you’ve submitted or acquired from inside the your own separation and divorce to make sure that you do not break people requests one to implement to suit your needs. While you are nonetheless undecided, consult with an attorney before you can replace the action.

Taking Help with the household Home

If you are hoping to keep house as an element of your splitting up, it is advisable to at the least speak with legal counsel. An identical is valid when you’re ready to throw in the towel their need for the house or property-most likely in exchange for staying other possessions such as for example old-age profile.

A skilled household members legislation lawyer can also be take you step-by-step through the options for dealing with your family domestic from inside the divorce proceedings while the consequences of different choices, assist discuss the best settlement which is it is possible to given debt items, and you may explain exactly how a legal in your county tends to handle the family family if you aren’t capable arrive at a settlement.

When you’re considering deleting one mate about deed on the the ones you love domestic outside of the divorce framework-like when you need in order to re-finance the borrowed funds on term of your own companion that have a much better credit history-select conversing with a lawyer you learn all courtroom outcomes on the state.