Nebraska, noted for the huge plains and steeped farming record, is even a flourishing heart for multifamily housing. That it Midwestern county also offers an alternate blend of metropolitan lifestyle and you can rural charm, it is therefore a stylish location for multifamily possessions opportunities. We proudly also provides funding characteristics in Nebraska, catering to all types of multifamily functions. Regardless if you are seeking to funds an effective duplex inside Omaha or an effective big apartment cutting-edge into the Lincoln, all of us is preparing to help you with your financing needs.

Nebraska’s multifamily housing market is as diverse as the landscape. Of active city accommodations so you can calm residential district townhouses, you will find property types of to suit most of the investor’s liking. All of our investment services are made to support that it variety, giving versatile mortgage selection you to definitely cater to a wide range of investment procedures. With our let, you can turn Nebraska’s multifamily houses prospective on the a successful fact.

Economy inside the Opinion

Nebraska’s savings is as robust as it is diverse. Depending on the Bureau regarding Work Statistics, the official comes with proper blend of areas, that have farming, development, and you can characteristics groups leading the way. This economic diversity brings a constant base to have multifamily possessions investment. In addition, group changes expressed by U.S. Milliken loans Census Agency tell you a steady increase of citizens to the towns, next fueling need for multifamily casing.

Degree and you can healthcare are high members so you can Nebraska’s savings. The official hosts multiple prominent universities, like the University from Nebraska-Lincoln and you will Creighton College. These organizations besides give top quality knowledge plus subscribe to neighborhood benefit by attracting children out of across the country exactly who need construction. Likewise, new medical care industry, having major business instance Nebraska Drug and you will CHI Fitness, makes use of a lot of residents, creating a constant need for multifamily property in the vicinity of this type of establishments.

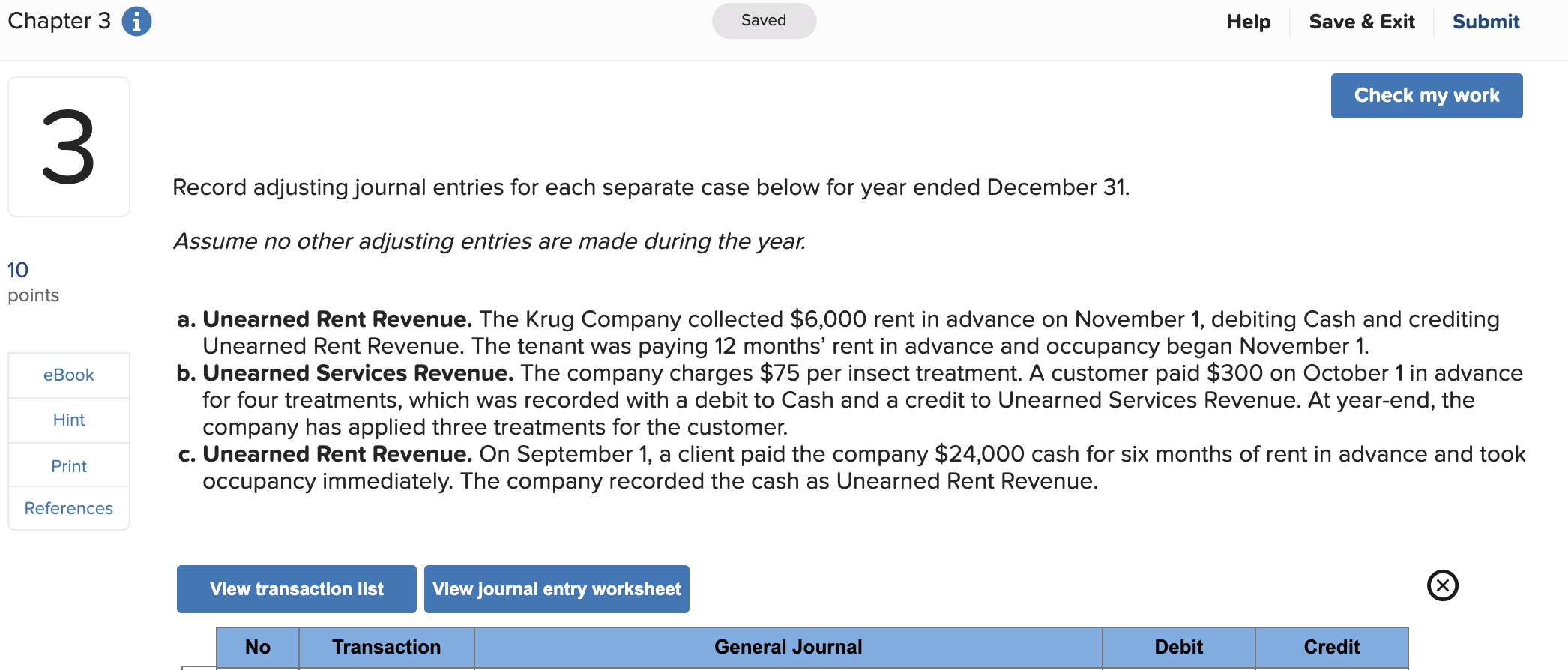

Today’s Rates of interest within the Nebraska

Look for the present multifamily mortgage costs getting Nebraska about table lower than. Talking about upgraded every day to make certain there is the better image of the financing conditions you will get.

Take note that these is standard index rates just – every mortgage equipment gets a speed one may differ based on the house, the region, this new borrower’s monetary electricity and experience, and several additional factors.

Our very own Masters

With respect to bringing an excellent multifamily mortgage, how many alternatives are going to be daunting. What it most mode, not, would be the fact there are amazing potential getting flat state-of-the-art investors irrespective away from venue, possessions size, otherwise feel peak.

Multifamily Fund links consumers having lenders across the country who are prepared to offer very competitive terminology. Regardless if you are to buy, development, otherwise remodeling an apartment strengthening, looking the loan so you can multiple lenders – not merely the bank or borrowing from the bank partnership across the street – provides you with a big virtue.

All of our experienced team of financing markets advisers will origin the actual most readily useful terms and conditions from your unequaled circle from lenders to make certain the possessions provides the ideal financing terminology available. We provide this particular service free away from charge.

Finding much more information about Nebraska? Read on lower than. Or even, click on the button below, and we’ll get right back for you with your totally free multifamily mortgage price.

Multifamily Fund within the Nebraska by-purpose

There are many reasons to find a separate multifamily mortgage having a home. I will not safeguards each of these, but let’s talk about the „huge around three” reasons why you should rating financial support: framework, acquisition, and you may refinancing.

Acquisition Funding having Multifamily Attributes within the Nebraska

To shop for a condo strengthening is one of the most prominent grounds traders imagine a beneficial multifamily mortgage. Also, it is that put of several get wrong: Financing terms is also in person change the profits out-of an exchange inside a serious means (one another positively and you may negatively).