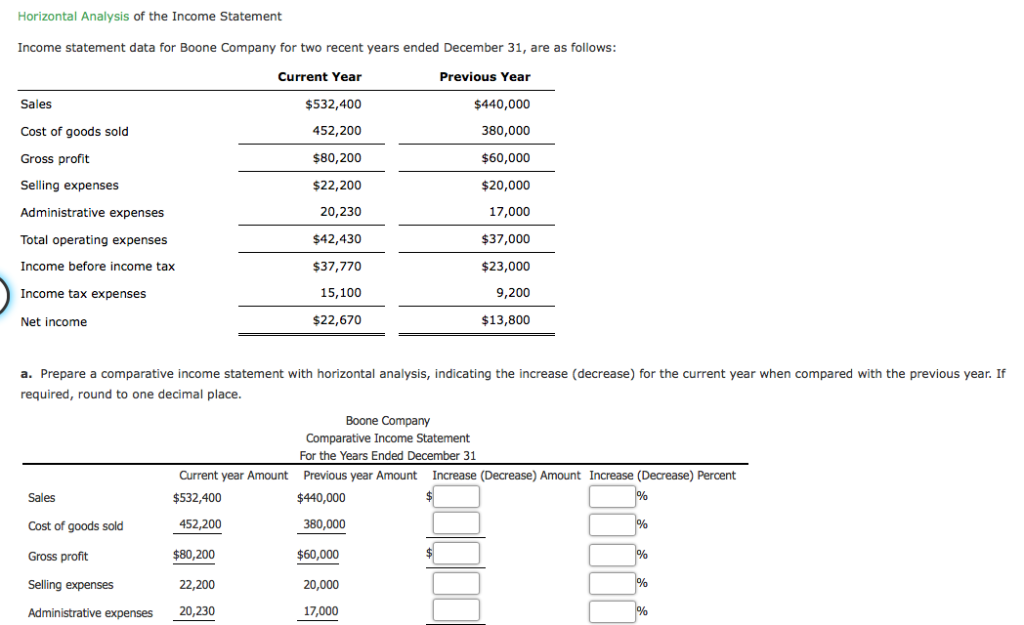

In analyzing the income statements of a retail company, an analyst notices steady annual growth in revenue over the past five years. By performing a horizontal analysis, the analyst calculates year-over-year revenue growth rates, observing a consistent upward trend. However, the analyst also finds that the cost of goods sold (COGS) has been growing at a slightly faster rate than revenue. This trend raises a concern that rising production or supply costs may be compressing profit lien sales, division of motor vehicles, department of administration, state of alaska margins, prompting the analyst to recommend strategies for optimizing inventory or renegotiating supplier contracts. By conducting a horizontal analysis, you can tell what’s been driving an organization’s financial performance over the years and spot trends and growth patterns, line item by line item. Ultimately, horizontal analysis is used to identify trends over time—comparisons from Q1 to Q2, for example—instead of revealing how individual line items relate to others.

Step 1: Gather Financial Information

The concept emerged from the need to track financial metrics across reporting periods to spot variances and identify performance patterns. Some of the earliest documented uses of horizontal analysis date back to the 1920s and 1930s when accounting textbooks and publications began covering it as an important analytical approach. Its use expanded over the following decades as more companies adopted annual financial reporting and analysts needed tools to compare statements. The rise of spreadsheet software in the 1980s and 1990s made it much easier to apply horizontal analysis, further boosting its adoption. Companies can compare their financial performance against industry peers to identify strengths and weaknesses.

- For instance, by identifying trends in revenue and expenses, management can make more informed decisions about resource allocation.

- Each of these provides important metrics that allow analysts to assess a company’s performance over time.

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

Calculate the Percentage Change

The general and administrative expenses also grew by 2.1% from Rs 39,426 million to Rs 40,250 million. The profit before tax marginally declined by 0.3% from Rs 98,438 million in 2023 to Rs 98,147 million in 2024. The net cash generated from operating activities for the year ended March 31, 2024, was Rs 176,216 million compared to Rs 130,601 million for the year ended March 31, 2023. The current liabilities stood at Rs ₹ 25,245.80 Crores as of March 2024 compared to ₹ 26,775.30 Crores as of March, 2023.

How to Read & Understand an Income Statement

For example, if revenue is growing but net income is declining, this could indicate rising costs or inefficiencies that are eroding profitability. Conversely, if both revenue and net income are increasing, it suggests that the company is not only growing but also managing its costs effectively. This holistic view helps stakeholders understand the underlying drivers of financial performance and make more informed decisions. Horizontal analysis can be conducted using various methods, each offering unique insights into a company’s financial performance over time. On the other hand, comparability constraint dictates that a company’s financial statements and other documentation be such that they can be evaluated against other similar companies within the same industry.

Welcome to F9 Finance!

The 50% still represents a positive outcome from 2018 even though it still represents an overall decline in the growth of revenue. We offer expert-driven advice and resources to help you earn, save and grow your money. Dillon Jacobs is a passionate value investor who believes in the fundamental principles of Superinvestors like Warren Buffett, Charlie Munger, Ben Graham, Peter Lynch, and many more. His career has taken him to many destinations around the globe, and he has lived in both Asia and Europe. Dillon Jacobs is a passionate value investor who believes in the fundamental principles of investors like Warren Buffett, Charlie Munger, Ben Graham, Peter Lynch, and many more.

Horizontal analysis of financial statements can be performed on any of the item in the income statement, balance sheet and statement of cash flows. For example, this analysis can be performed on revenues, cost of sales, expenses, assets, cash, equity and liabilities. It can also be performed on ratios such as earnings per share (EPS), price earning ratio, dividend payout, and other similar ratio. Comparative financial statements involve juxtaposing financial data from different periods side by side.

Calculating horizontal analysis involves a systematic approach to comparing financial data across different periods. The process begins with selecting the financial statements to be analyzed, typically the income statement and balance sheet. These documents provide a comprehensive view of a company’s financial activities and position, making them ideal for horizontal analysis. Once the relevant financial statements are chosen, the next step is to identify the specific line items to be compared.

Commonly analyzed items include revenue, operating expenses, net income, assets, and liabilities. By focusing on these key metrics, analysts can gain a deeper understanding of the company’s financial dynamics. Horizontal analysis is a method of financial statement analysis that compares financial data from one period to another. This technique is used to identify trends or changes in a company’s financial performance over time and can be applied to various financial statements.