The contribution margin income statement is a special format of the income statement that focuses on bifurcated expenses for better understanding. Looking at this statement, it can be easily understood as to which business activity is resulting in a revenue leak. The fixed production costs were $3,000, and fixed selling and administrative costs were $50,000. Variable production costs were $1,000 per unit, and variable selling and administrative costs were $500 per unit.

Company

If variable expenses were $250,000, so you’d have $385 in variable expenses per unit (variable expenses÷units sold). For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or 50%. For certain other indirect expenses, accountantsbase allocation on responsibility for incurrence. For instance,assume that Segment M contracts with a magazine to run anadvertisement benefiting Segment M and various other segments ofthe company. Some companies would allocate the entire cost of theadvertisement to Segment M because it was responsible for incurringthe advertising expense. The two basicguidelines for allocating indirect fixed expenses are by thebenefit received and by the responsibility for the incurrence ofthe expense.

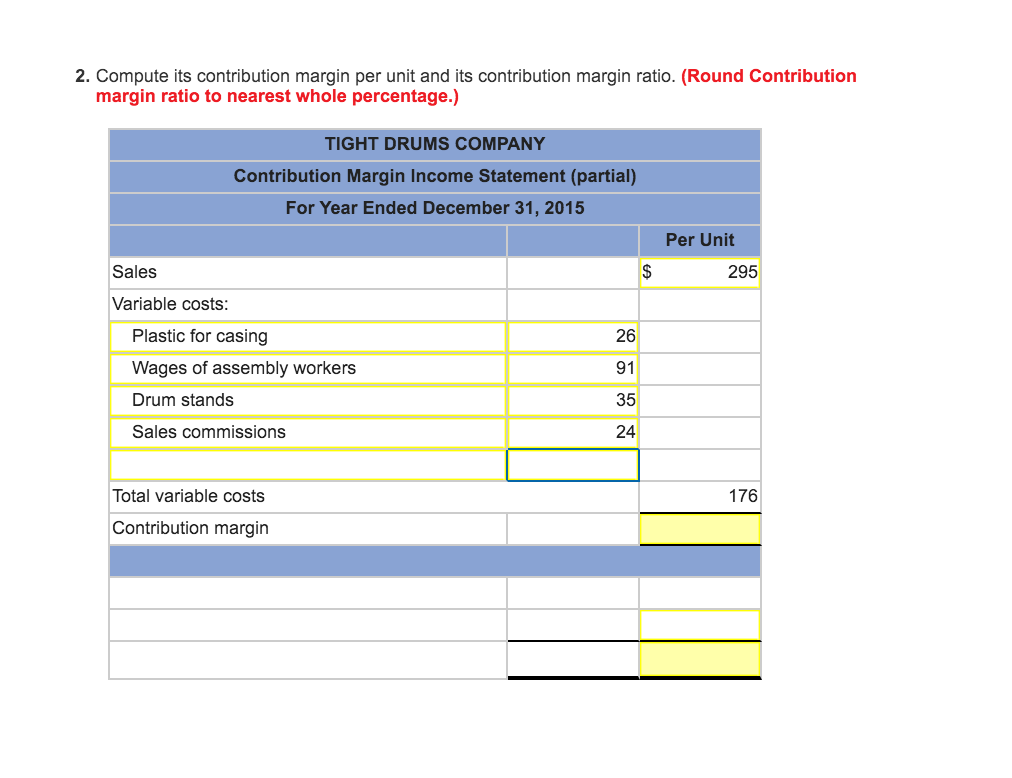

( .The difference of format:

Variable costs can include production expenses, such as materials, supplies and overhead, as well as variable selling and administrative expenses, such as sales commissions and distribution costs. The contribution margin measures the contribution of the sales efforts toward the company’s profits, without regard for fixed costs, taxes or other costs not directly related to sales. For instance, if XYZ Widgets Inc. had $500,000 in annual sales and $200,000 in variable costs, its contribution margin would be $300,000. In a contribution margin income statement, variable cost of goods sold is subtracted from sales revenue to obtain gross contribution margin. The variable marketing and administrative expenses are then subtracted from gross contribution margin to obtain contribution margin.

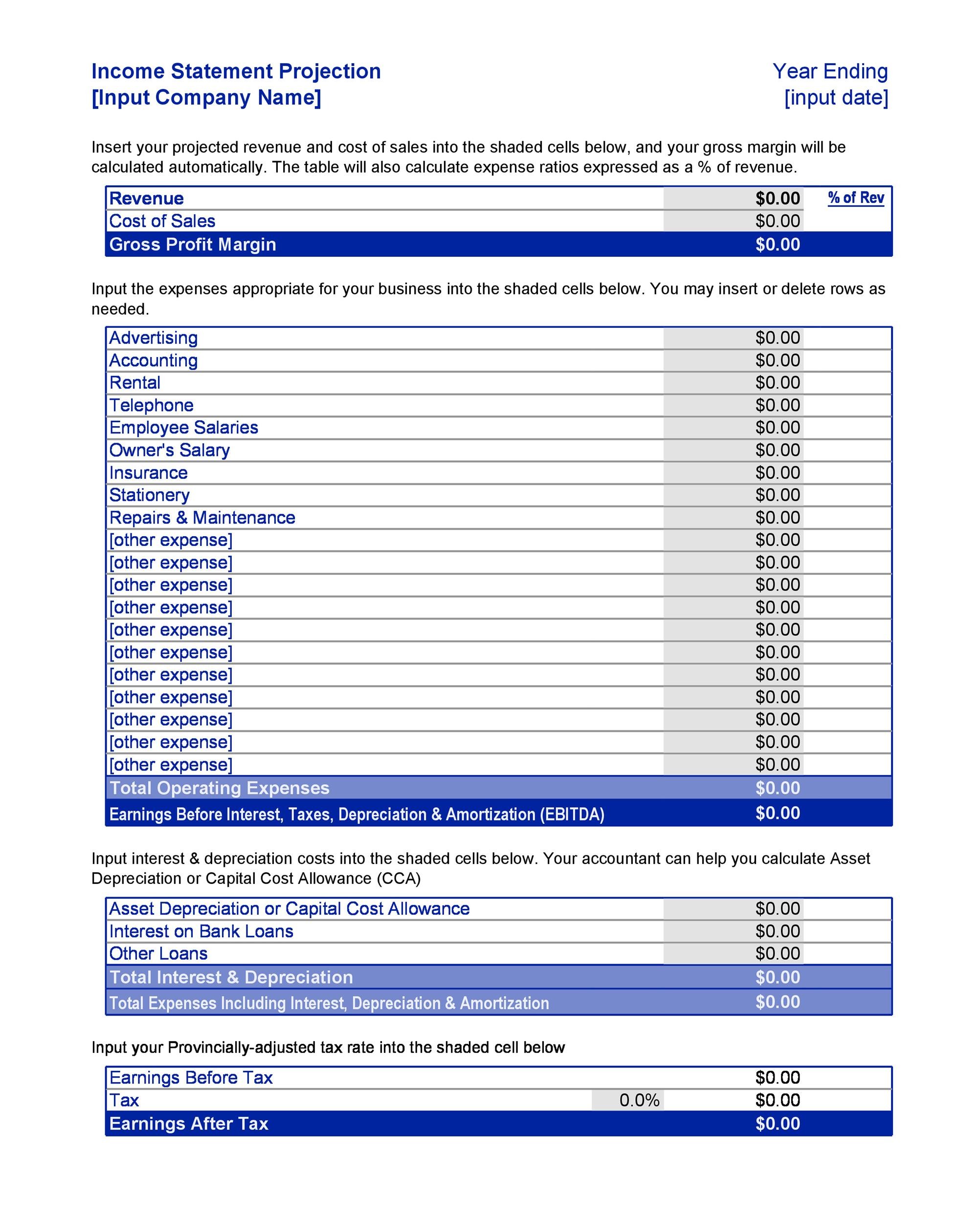

Contribution Margin Per Unit

Contribution margin income statements can help business managers control costs, set prices, and make decisions about business segments, such as expanding profitable product lines or discontinuing less profitable ones. This format is called the contributionmargin format for an income statement because it shows thecontribution margin. The secondsubtotal in the contribution margin format peanut butter price history from 1997 through 2021 income statement is thesegment’s contribution to indirect expenses. Contributionto indirect expenses is defined as sales revenue less alldirect expenses of the segment (both variable direct expenses andfixed direct expenses). The final total in the income statement issegmental net income, defined as segmentalrevenues less all expenses (direct expenses and allocated indirectexpenses).

The problem with using segmental net income toevaluate performance is that segmental net income includes certainindirect expenses that have been allocated to the segment but arenot directly related to it or its operations. Because segmentalcontribution to indirect expenses includes only revenues andexpenses directly related to the segment, this amount is often moreappropriate for evaluation purposes. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company?

How do you calculate the contribution margin from EBIT?

- When it uses neither benefit nor responsibilityto allocate indirect fixed expenses, a company must find some otherreasonable, but arbitrary, basis.

- The more customers she serves, the more food and beverages she must buy.

- These costs don’t fluctuate with the level of production or sales an item makes—which is why they’re sometimes called fixed production costs.

- WASHINGTON — The Internal Revenue Service announced today that the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024.

- If XYZ Widgets Inc. used an effective tax rate of 20 percent, its tax expense would be 20 percent of $200,000, or $40,000, leaving a net income after taxes of $160,000.

Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. Prepare a traditional income statement and a contribution margin income statement for Alta Production. After further work with her staff, Susan was able to break down the selling and administrative costs into their variable and fixed components.

If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit.

It separates fixed and variable costs to show which products or services contribute most to generating profit. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.