- Overall bank score

- Benefits and drawbacks

- Citibank home loan interest levels

- Citibank compared to. Pursue mortgages

- Citibank compared to. Lender out-of America mortgages

- Just how Citibank mortgage loans performs

- Try Citibank trustworthy?

- Citibank financial FAQ

Insider’s professionals pick the best products to help make wise decisions along with your money (here is how). In some instances, i receive a payment from your all of our couples, but not, our viewpoints is actually our personal. Terminology apply at also provides noted on this page.

The bottom line: Citibank now offers a beneficial range of sensible mortgage choice, you need to correspond with a real estate agent over the telephone before you can complete your application. If you are searching to possess more give-carrying, that it bank might be helpful for your. But if you wanted a smooth, entirely on the internet sense, you may want to browse somewhere else.

Citibank financial interest rates

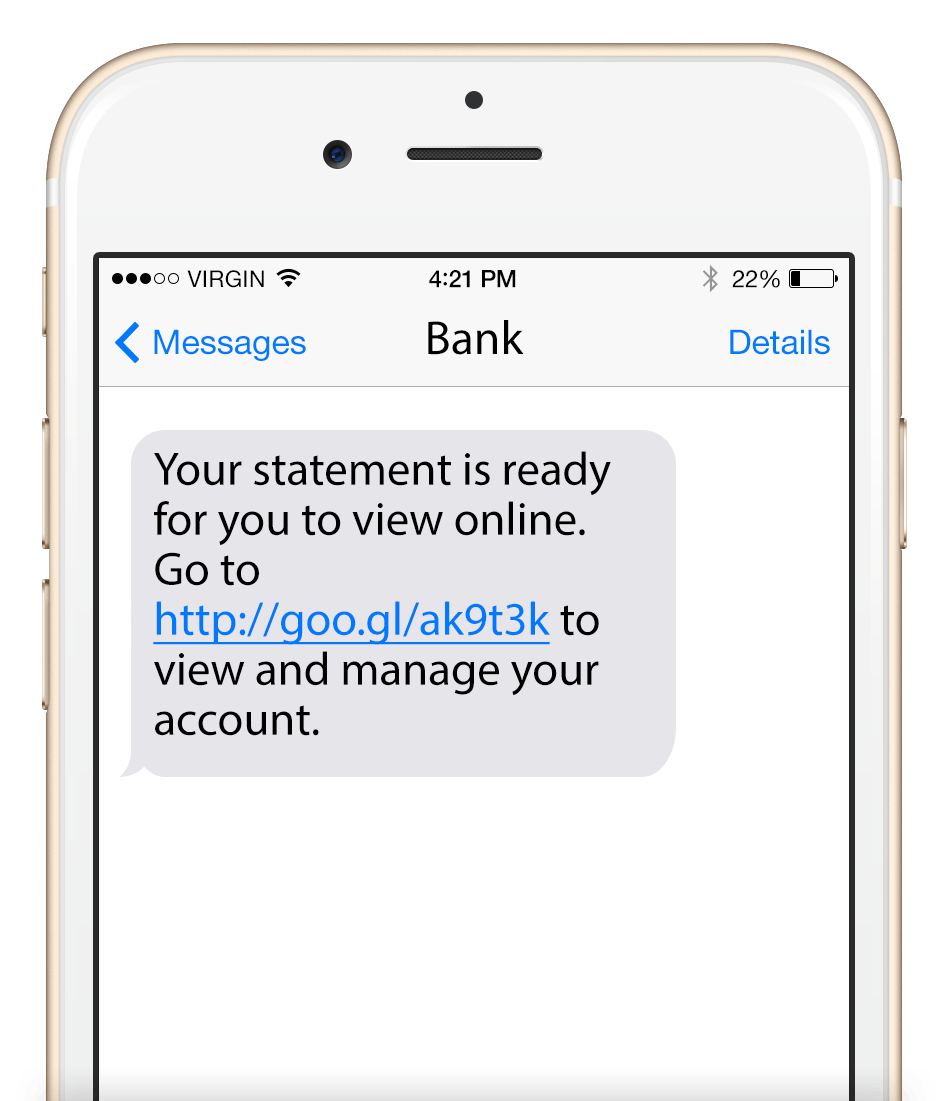

Citibank suggests shot financial costs for the 31-season and 15-12 months fixed-rate mortgages to your its web site. Observe these pricing, click „listed below are some the current prices” to the Citibank’s main family credit web page.

Taking cost customized with the own disease is a bit alot more complicated. To acquire a customized rate, you will need to go through the exact same process you might undergo to apply for a home loan which have Citibank: fill in a questionnaire together with your identity, phone number, and you will current email address therefore home financing user can also be telephone call your.

Citibank versus. Chase mortgage loans

Citibank and you will Pursue features equivalent home loan products, and additionally comparable expertise low-down payment financial activities. Citibank’s low down percentage mortgage is called the brand new HomeRun mortgage, therefore lets individuals place as little as 3% off no financial insurance rates needs. Chase’s DreaMaker together with allows 3% down money and supply individuals $five-hundred when they over an effective homebuyer training movement.

When you’re already an effective Citibank customers, you could potentially prefer to get a great Citibank financial so you’re able to take advantage of its customer cost.

Citibank versus. Financial out of The usa mortgage loans

Citibank and you can Bank of The usa also are quite similar on the mortgage loans they offer. One another lenders features a great 3% off, home loan insurance-free solution, and you can one another bring closure rates advice to own qualifying individuals.

Some loan providers, such as for instance Citibank, has actually set a stop on their family collateral offerings because of current market requirements, and thus HELOCs tends to be a tiny more complicated ahead by the. While needing an effective HELOC, Financial regarding The usa nonetheless even offers her or him, giving so it lender a base up over Citibank while some one are not currently acknowledging HELOC applications.

One another Citibank and payday loan direct lender no teletrack you may Financial from America offer rewards having newest customers, so if you already have a free account with your financial institutions, you can like to enjoy the coupons offered to you.

Exactly how Citibank mortgage loans work

Citibank develop mortgage loans across the country. To track down a mortgage that have Citibank, you will have to complete an internet function together with your identity, phone number, and you will email, or manage a free account. After a home loan affiliate have entitled one speak about your options and you may and that financial sorts of is best for your, you can make use of the web webpage to use, publish documentation, and you may track your application.

Citibank has the benefit of conforming, jumbo, FHA, Va, and you can HomeRun mortgage loans. HomeRun mortgage loans are around for lowest-to-moderate-earnings individuals and allow down payments as little as step 3% without having to pay financial insurance coverage. Citibank will even imagine low-antique borrowing from the bank out of being qualified individuals of these mortgage loans, but when you go which route, you will need to place about 5% down.

FHA mortgages require the very least deposit out-of step three.5%, while Va mortgage individuals get home financing with 0% down. Compliant home loan consumers need to place no less than 5% down.

Citibank now offers as much as $5,one hundred thousand in closing pricing assistance to qualified lower-to-moderate-money consumers and you may unique costs for brand new or established put membership users. not, you need a fairly high harmony to take advantage of the more appealing costs advantages. If your harmony is actually lower than $fifty,one hundred thousand, you’ll receive $five hundred from the settlement costs. People with higher balance can get a certain fraction off an effective percentage off their interest.

You can name Citibank’s domestic financing line to start a loan application otherwise ask questions regarding the the mortgage loans Tuesday using Saturday from 8 a.meters. to 10 p.meters. Mais aussi or Tuesday off 9 a beneficial.meters. so you’re able to seven p.yards. Mais aussi.

Try Citibank reliable?

Citibank enjoys won a keen F get on the Better business bureau due to problems which were not taken care of immediately or unresolved, and you may on account of authorities step up against the lender. Better business bureau levels are derived from a good business’ trustworthiness when you look at the ads, transparency on their providers practices, and you will abilities inside responding to customers complaints.

Into the 2020, Citibank was bought because of the Item Futures Exchange Fee to blow an excellent $cuatro.5 billion penalty. The CFTC told you the financial institution didn’t steer clear of the deletion off subpoenaed audio tracks because of a well-known problem with their sounds maintenance system. Citibank was also fined $eight hundred million because of the Office of the Comptroller of your Currency, and therefore advertised one to Citibank didn’t fix a lot of time-label chance management products.

Citibank financial FAQ

Sure, Citibank has the benefit of mortgage loans. If you could well be so much more familiar with Citibank just like the bank for which you get checking and savings membership, Citibank even offers a multitude of lending products, along with mortgage loans, unsecured loans, and using profile.

Citibank screens two sample pricing toward their site, however, locate a customized rate, you will have to keep in touch with home financing associate. To your the Zillow lender profile, of several writers indexed one its pricing had been below questioned.

Citibank was ideal for you if you’re looking to possess reasonable mortgage solutions, like the lowest down payment financial without home loan insurance coverage, or you you desire individualized let picking out the mortgage that is right to you.