Once you look at your earnings, you may want to feel just like optimizing your loan costs could help their condition. Combining the debt you are going to give you having less or maybe more conveniently timed repayments per month if you have several financial obligation costs. The easiest way to accomplish that is with car loan consolidation.

What exactly is Car loan Consolidation?

Having financing consolidation, you need yet another sorts of financing to borrow cash and you will pay back your dated obligations. This consolidates your debt below you to the fresh loan. Officially, there isn’t a particular type of mortgage to have consolidating car loans. The newest mortgage might possibly be a keen unsecured personal bank loan, a property collateral mortgage otherwise credit line, otherwise a charge card.

Just how Consolidation Is different from Refinancing

Merging an auto loan differs than simply refinancing the car loan. When you re-finance a car loan, you always remove a special auto loan to complete your goal from a lowered interest otherwise down monthly payment. Banks safe these types of money with your auto, which gives the lender an effective way to recoup a number of the money owed as a consequence of repossession if you don’t build payments. This could lead to down interest levels than simply personal loans.

Specific auto combination loans is actually unsecured, and therefore loan providers need a bigger exposure lending you the money. So you’re able to mirror this risk, unsecured vehicles integration funds might have highest interest levels than simply good auto refinance loan. It means it is possible to spend even more during the appeal with an integration loan than simply having car finance refinancing. Yet not, auto combination mortgage individuals might have most other needs than just achieving a down rate of interest or a lower life expectancy payment per month. As an instance, you will be trying to provides fewer monthly obligations complete.

Simple tips to Consolidate a car loan

The whole process of combining an auto loan is easy. Very first, figure out what form of loan we want to use to consolidate your car or truck funds and any other financial obligation we want to consolidate. It an unsecured loan, charge card, mortgage, or house equity personal line of credit. You may provides other choices based your position.

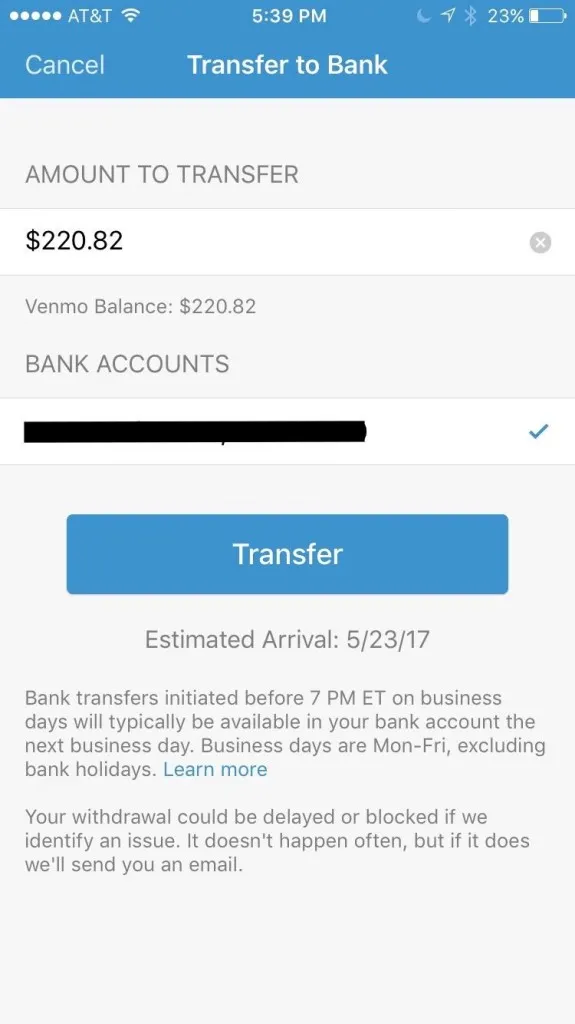

When you aim for the mortgage type we would like to fool around with and have that loan in line, you should consult a rewards quotation for any car and truck loans or other finance you need to combine along with your the brand new loan. This provides you the overall sum of money you really need to consolidate this new loans you want to repay. The brand new financial may physically repay your own old finance or give you the money to expend the latest loans out-of your self.

In either case, find out if all old loans was paid in full before your prevent making repayments. If you don’t, you can also pay later fees or other costs in case the payoffs you should never read once you predict.

Imagine if you really have a couple of $10,000 car and truck loans. You’ve decided we would like to consolidate using property collateral mortgage to stretch-out the newest monthly installments more than a longer period out-of go out. Very first, you’d make an application for a house security financing and possess acknowledged to own the borrowed funds matter need. To choose that it, you need to ask your lender once you expect you’ll close to your the mortgage. Next, consult an incentives amount of each of the car loan companies based on you to definitely time. Because the loan is approved, make use of the fund to pay off all of your old vehicles fund.

Requirements to have a motor vehicle consolidation mortgage confidence the type of loans you employ. However, here are a few standard requirements lenders pick:

How exactly to Consolidate Auto loans With other Brand of Fund

For some fund you employ so you’re able to combine car and truck loans, you could have a tendency to combine most other mortgage sizes. Loan providers never fundamentally care what brand of financing you consolidate, so long as you can get acknowledged towards consolidation loan. You have got of several facts to consider before combining numerous financing brands together.

To the positive top, merging multiple finance you could end up less monthly premiums. If you have a high interest, you will be in a position to safe a lower life expectancy price. This is particularly true by using a property collateral financing. Alternatively, you will be looking a complete down payment across all your valuable loans. You might accomplish this by firmly taking away a lengthier-term mortgage.

Merging multiple funds toward one mortgage enjoys threats, as well. By firmly taking away a house collateral loan, lost an installment you could end up foreclosures in your home. Signature loans you could end up a top interest or more appeal reduced across the amount of a lengthier financing term. By the merging their loans, you could potentially end taking right out even more obligations from the coming. This could put you inside the a bad budget.

In addition it commingles your debt. When you yourself have multiple funds, you might pay that loan through to the anybody else and lower the overall payment per month numbers. That have good consolidated loan, you only pay off the whole equilibrium before the monthly payment goes away.

Pros and cons out-of Consolidation

- A lot fewer monthly installments

- Down monthly installments

- Straight down interest levels

- More hours to expend right back your loan

Car loan consolidation possess several cons to consider. Depending on how your consolidate your own financing, you may feel several of these disadvantages:

- Making money for a longer time

- Purchasing significantly more notice over the loan’s lives

- Increased interest rate

- Probably negative credit rating has an effect on

Believe If Integration Is right for you

Consolidating your vehicle loans could make feel to reach your financial desires. Occasionally, your age date. In advance of combining, carefully have a look at the advantages and disadvantages of all choices just before swinging forward into procedure. Just after consolidated, you can’t return to their earlier in the day financing preparations.

This site is for instructional motives merely. The next activities noted aren’t associated with Money You to and you will was entirely responsible for the opinions, products. Resource One to cannot bring, promote otherwise make certain people third-class equipment, services, recommendations otherwise recommendation mentioned above. The materials in this post is thought to-be exact in the course of guide, it is subject to transform. The images shown try to have example intentions only and may also maybe not be a precise image of tool. The information presented considering on this site isnt intended to give legal, financing, otherwise financial pointers or to indicate the brand new availableness otherwise viability out of any Financing One to service or product towards book things. For particular advice about your specific products, you are able to need to demand a professional elite.

I started training the thing i you will throughout the individual fund as i attended school. It turns out that has been one of many wisest choices I have produced. Now, I wish to show one education to you. By what I’ve learned because of my studies and feel, I make an effort to help you produce advised choices regarding vehicle to purchase and you can lending procedure while spending look at more info less at the same time.