There isn’t any private mortgage insurance policies (PMI) which have Virtual assistant money. However, Virtual assistant loans would feature a compulsory investment fee you to definitely happens straight to the brand new Agency out of Pros Things. Individuals with an assistance-connected handicap try exempt regarding spending which payment. This will help to save money on the brand new monthly payments and initial will cost you. This will make a sacramento or Placer Condition home less expensive.

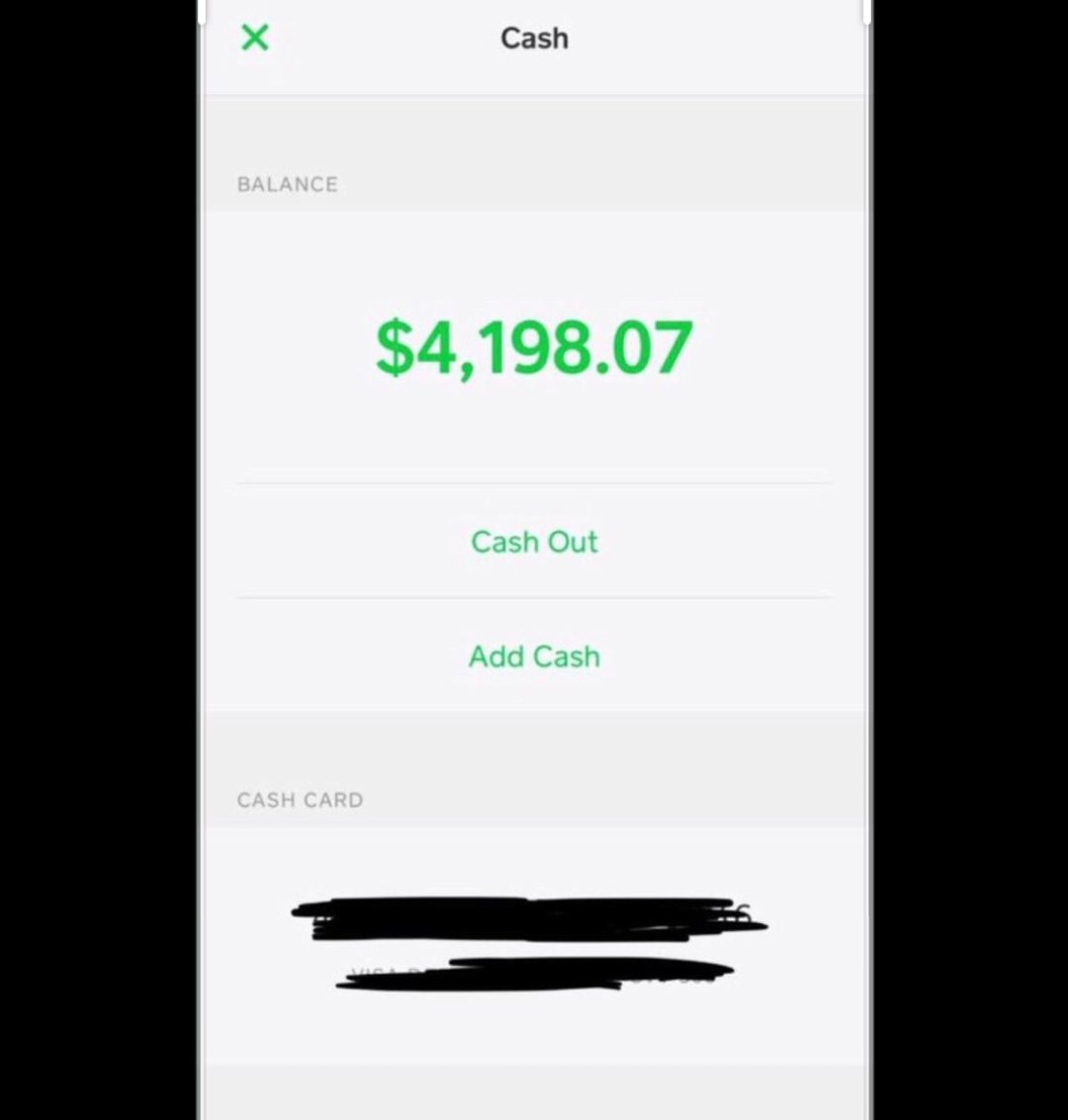

Within the 2022 the latest Va capital percentage prices try because the implemented:

![]()

Settlement costs are part of bringing home financing. The latest Va in reality constraints what charge and can cost you pros can pay at the time of closing. That isn’t usually a good topic. Often it can be complicate a real property transaction. The newest experienced family visitors get certain closing costs recommendations.

The home consumer/s normally query vendors to spend almost all their loan-associated closing costs or more to help you cuatro percent of the purchase speed to have such things as prepaid taxes and you may insurance, stuff and you can judgments. Do you consider new seller’s may wish to do that? Do you think certain seller’s cannot accept an offer when the its expose that it will become an excellent Va financing customer? I’ve had numerous marketing made more challenging to close off since out-of expectations of the fresh veteran buyer considering they’re going to automatically get this type of seller’s concessions. Real estate is payday loans Frisco the art off negotiations. The experienced consumer having a good Virtual assistant financing could add value to help you the order or perhaps a challenge. Its as much as the true estate agents so you’re able to discuss a good a great winnings-earn price.

4. Brand new Virtual assistant loan may have looser borrowing standards or otherwise not.

Understand a number of the almost every other experts you should know just what an excellent Virtual assistant Mortgage is. Good Virtual assistant financing was home financing awarded by private loan providers and you may partly recognized, or secured, of the Agencies out of Pros Facts. It is therefore clear, the fresh Department from Pros Points doesn’t make a beneficial Virtual assistant Loan. The Va Mortgage is a hope to the financial to possess area of loan value. That is correct. Maybe not the complete mortgage but a share of the mortgage really worth.

Loan providers usually nevertheless check your fico scores, money height, or any other factors to select recognition, therefore the interest rate you get so the borrowers meet lender conditions. On one hand the lending company seems they can has loose mortgage requirements because the part of the financing try guaranteed. But on the other hand it is hard and you will expensive to foreclose toward a home loan. The way the financial balances these problems have a tendency to dictate the 2nd pair experts play out. And why you should listed below are some more than one bank to possess a beneficial Virtual assistant mortgage.

5. Particular Va loan companies can work having large DTI ratios so you’re able to make financing.

Va lenders basically make use of the level of 41 percent of the terrible month-to-month income on major expenses, such as for instance a mortgage commission otherwise college loans. However some lenders need a great deal more Virtual assistant loans toward courses and you will deal with increased DTI proportion whilst still being generate an effective Virtual assistant home loan. Certain lenders might have to go around 55 percent or higher created on the power to pay back the borrowed funds centered on money or any other borrowing from the bank items. This may enable it to be more comfortable for certain buyers to maximise the family to buy strength. This new monthly homeloan payment is actually influenced by the attention costs on the time of your own mortgage. Va financing are known for their competitive costs.

6. Particular Va loan companies can work with foreclosures and you can personal bankruptcy finest.

Particular Virtual assistant loan companies are working to your issue of foreclosure and you will case of bankruptcy. Other people doesn’t. You can safe a Va home loan just one or two ages taken out of a foreclosures, quick revenue or personal bankruptcy. Oftentimes, experts just who declare Part 13 personal bankruptcy cover would be qualified simply annually taken off the brand new submitting day. Even when the experienced provides a property foreclosure on the a good Virtual assistant-recognized home loan, he may nevertheless be entitled to an alternative.