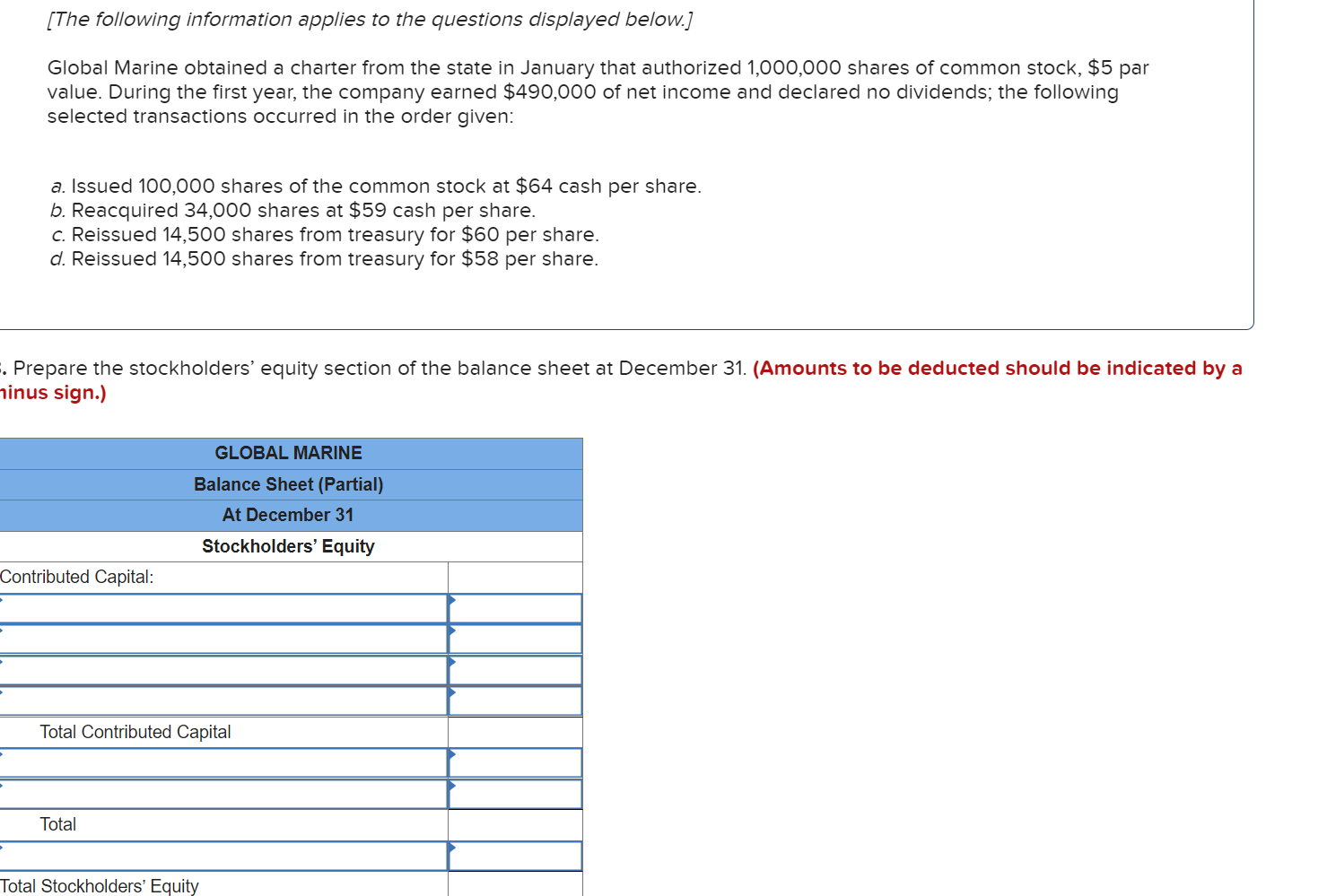

While doing so, so you’re able to be eligible for an HECM, you should discover reverse home loan guidance off an effective HUD-accepted guidance company. Reverse home loan counselors are instructed and you may approved by HUD to include objective information in order to the elderly. Once you speak to that, they will certainly define choice so you can an enthusiastic HECM, contrary financial will set you back, payment plan selection, and a lot more.

You will do. During the a face-to-face home loan, you retain brand new identity to your residence and sustain possession. It means youre nevertheless guilty of assets fees, homeowner’s insurance coverage, utilities, repairs, maintenance, or any other expenses.

Is reverse mortgages a scam?

Contrary mortgages are perhaps not a scam, however dishonest people use them so you’re able to exploit users. New FHA retains a list of genuine reverse mortgage lenders you to definitely provide HECM finance. Check your financial at the HUD.

Might you reduce your house which have an opposite home loan?

Yes, just as in a vintage home loan, you could potentially get rid of your residence to help you property foreclosure having an opposing mortgage. It just goes below particular issues, instance:

- You prevent investing property taxes and you may homeowner’s insurance policies.

- Your stop making use of your family once the a primary household, if your perish, circulate, offer the house, otherwise try far from home for a long period regarding day.

- You are not able to see FHA requirements within the maintaining the home.

What is the drawback away from a face-to-face financial?

A reverse home loan can be a useful product within the making certain an effective more secure retirement and you may remaining in your house because you decades. But not, you will find several disadvantages to adopt. Check out:

- You’ll find charge involved. When you located repayments that have an other home loan, it’s not free. In addition to possessions taxation, restoration, or any other expenses, you might have to spend settlement costs and you may servicing fees more than the course of the loan. Some lenders along with charges financial insurance premiums. This new Federal Reverse Mortgage lender Organization (NRMLA) provides an other financial calculator to obtain an idea of the can cost you. Fees are very different because of the lender, and if you are offered an opposing mortgage, make sure you shop around.

- You only pay additionally date. Once your reverse mortgage repayments initiate, attract is actually included into your debts per month. The quantity you borrowed grows since this attention increases throughout the living of one’s mortgage.

- You have got shorter to depart on heirs. Having an availableloan.net/payday-loans-ar/appleton/ other home loan, you can easily constantly must promote your house to pay-off the mortgage. After you perish, your family members or any other heirs would need to pay often brand new complete loan equilibrium or 95% of your own house’s appraised really worth (whichever was faster). Concurrently, contrary mortgages processor out within collateral of your house, causing a lower life expectancy earnings if it is ended up selling.

- Pension benefits is influenced. Having a face-to-face mortgage could make you ineligible to own you prefer-based bodies programs including Extra Coverage Earnings (SSI).

- You can’t deduct the interest on your own taxes. In the place of having traditional mortgages, the interest with the opposite mortgage loans is not allowable in your earnings tax statements up until you’ve repaid the borrowed funds (partially or even in complete).

Are opposite mortgage loans well worth it?

Taking right out an opposite home loan isnt suitable for folks-but also for certain the elderly, it can be convenient. You happen to be an effective candidate to own a contrary mortgage in the event that you reside gradually expanding for the well worth therefore plan to real time indeed there for a long time. Also, it is essential that you keeps tons of money flow so you’re able to defense the expense of your property and stay most recent on your own reverse home loan.

Download our help guide to contrary mortgage loans and

If you are an older citizen who wants to stay-in your own household since you decades, the audience is right here to greatly help. Talk about your options to possess tapping into your own residence’s equity with these free, federally accepted user publication: Make use of your The place to find Stay at home. Discover more and you will obtain the booklet now.