- Lifetime within WMC

- In news reports

- House Life

- Home loan Axioms

- Industry and you will World

- Broker Resources

When your credit history are sub-standard, here are a few these suggestions for boosting your get and you can wanting an excellent home mortgage that suits your position.

A corner out-of being qualified to possess a mortgage is the credit rating. Their score helps loan providers figure out which financing applications you might be qualified to receive and what sort of interest rate you can purchase. Essentially, your credit rating assists loan providers influence the likeliness to pay right back your own home mortgage and in the end influences your ability purchasing an excellent family.

How come they do this? Better, your credit rating is based on multiple facts, for example payment record, overall balance due, borrowing mix, and a lot more. Many of these everything is a good indications of the capacity to spend the financial.

That being said (normally), the greater your credit rating, the more financing software you are eligible for. You’ll also probably get a good rate of interest – since you happen to be thought an effective safer debtor.

This may voice a tiny disappointing when you yourself have what’s thought are a less than perfect credit rating. However, that isn’t the conclusion-all the-be-all, so there are methods locate home financing that have a poor credit score. Both most frequent choice are: work to change your score and you may/or mention your own home loan program selection.

Look at the Credit rating

Earliest one thing earliest: when you need to change your credit rating, you should know the goals. It might be useful to manage an intense plunge and you may acquaint oneself together with your whole credit collection. Keep a copy of credit reports and look on the some thing like:

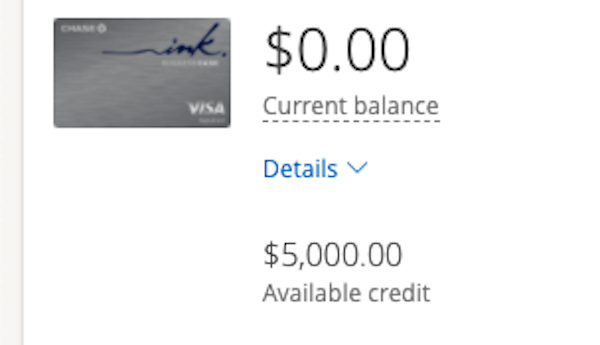

- Exactly what your credit rating is

- Credit lines you have discover

- Brand of borrowing utilized

Spend Your own Debts on time

Succeed a priority to constantly shell out your own costs punctually. This is exactly one of the main items one to impacts your borrowing rating, therefore it is a significant you to definitely stay glued to. If you have the substitute for join car-pay money for their credit cards or financing, it can help keep you on track. In addition to, it is possible to usually have the option to put the new booked commission matter (minimal owed, full balance, or some other amount of their choosing), so that you continue to have certain independence.

Pay-off Your debt

A new guaranteed means to fix boost your credit score will be to ount of personal debt you owe. There are many popular tips for paying debt, but it all boils down to one first premises: become competitive and place the additional currency you have got on your own debts.

Consult a card Therapist

We have been home loan gurus here at Waterstone Home loan, however, we suggest looking for an experienced borrowing elite who can give you a lot more from inside the-depth advice. If you’d like direction, select a city mortgage professional near you and one out-of our very own most useful-notch home loan professionals could be happy to send you to definitely a great borrowing from the bank resolve pro.

Select a mortgage loan that have Flexible Borrowing Standards

There are numerous mortgage applications out there with versatile borrowing standards. Unfortunately, this isn’t always the newest wonders answer – you might still have to take a number of the above methods adjust their credit (a beneficial Waterstone Mortgage loan elite can be describe for every system in depth while you are interested in whether you are able to be considered).

If you find yourself traditional financing will often have large credit score criteria, a number of the financing software we offer for these with lower credit scores – some only 580 FICO – include:

When you’re speaking of the most widely used lower-borrowing home loan alternatives, which number isn’t exhaustive. Look for a region financial professional in your area knowing a little more about the choices otherwise score pre-accepted today.

Every piece of information provided a lot more than is intended for informational objectives simply and you will never constitutes legal advice or credit counseling.