Having historically low interest, you’re probably watching a fair show of news points saying what a lot of fun it is so you can re-finance your property. Anyway, refinancing shall be a sensible financial disperse whether it contributes to decreasing monthly installments, reducing financing course, or building household security more quickly. However the big concern lingers: Just how in the future would you (otherwise any time you) re-finance shortly after to acquire a property or condominium?

Ahead of calling a loan administrator otherwise financial servicer from the refinancing, just take a read through the following few chapters of this information to see if refinancing suits you.

So what does they imply to refinance?

Put simply, refinancing is substitution your financial with a brand new you to definitely. Here is as to the reasons that might be an option, even if you provides a great rates already:

- You want to clean out monthly obligations that have a lower rate of interest otherwise a longer-title (or one another)

- You desire to pay back the financial less because of the shortening the latest conditions

- You have re-analyzed that have a varying-rate mortgage (ARM) and wish to convert it to help you a fixed-rate home loan

- You have got financial hardships, home improvements, or a primary buy nearby and also you want to make use of your house equity

- Your credit rating has improved causing you to qualified to receive a better rates

- We need to dump PMI (Individual home loan insurance coverage) one was included with their brand new loan

- You have as received married or separated, and you must create or subtract someone from the loan

The clear answer are „prior to when do you believe,” though it depends on the latest re-finance system you are looking for, the borrowed funds variety of, and if one charges use. It may seem dumb to help you refinance when you had the procedure and you may paid closing costs on your totally new home loan, however in some cases, it could save a lot of money over the lifetime of brand new loan.

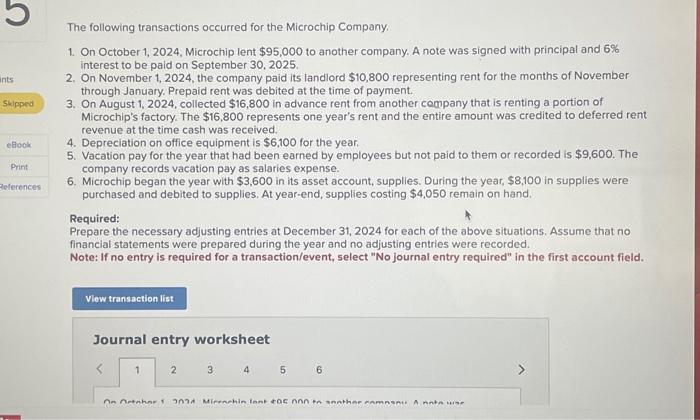

Even though you can theoretically refinance immediately, specific loan providers may require that wait days in advance of refinancing having a similar team. If the capitalizing on best words is your chief believe, the path are clearer. Below are a few mortgage re-finance laws and regulations and you will go out frames to consider:

- A cash-away re-finance, the place you was credit even more money up against your home collateral, typically has a six week waiting months (and you also most likely don’t possess this much equity invested in you to quick schedule in any event).

- For people who went to your mortgage forbearance otherwise got your own completely new financing restructured to get you to skip or temporarily treat monthly premiums, you happen to be expected to hold off up to 2 years ahead of refinancing.

Just how long could you be planning to stay static in your residence?

Answering it concern allows you to know if refinancing will even sound right financially. As to the reasons? Like your unique mortgage, refinancing requires an assessment, an assessment, and you can closing costs – somewhere in the variety of 2% to 5% of your mortgage worth. Are you need a $500 loan in the home for enough time to recoup those fees?

Why don’t we check an excellent hypothetical problem: Consider your current financial was $1500 thirty day period, but you happen to be thinking of refinancing. Settlement costs or any other costs was projected to get to $4800, your payment is expected to decrease because of the $2 hundred 1 month. Having a yearly offers regarding $2400, might only start seeing genuine savings immediately after couple of years.

Do you really propose to stay in your property for at least you to definitely long? Refinancing might make experience. If you are not attending sit set for over 2 yrs, your possible savings may well not cover the price of refinancing. However, your mathematics tend to disagree.

Consider your credit file

Taking out fully a home loan can affect your credit history, and in case you’ve not had your home for long, maybe you have not made enough monthly obligations to improve your own score yet. Applying for a refinance mortgage shortly a short while later pings your credit score once more that will apply at your own qualifications. This may succeed challenging to rating yet another loan so you’re able to replace the old you to or negatively affect the rate you are offered.

Is the time correct?

Refinancing is entirely worth every penny if your day excellent, and it can feel a straightforward, straightforward processes after you manage a talented regional financing officer.

To get started, take a look at Direction Mortgage’s refinance items, otherwise, while ready, you can apply on the web.

Mitch Mitchell are a self-employed contributor in order to Movement’s sales company. The guy along with produces about technical, on line security, this new digital degree society, take a trip, and living with pets. He’d like to live someplace warm.