NerdWallet, Inc. doesn’t supply advisory or brokerage companies, nor does it suggest or advise investors to buy or promote explicit shares, securities or different investments. One lingering query is whether or not buying overseas will incur a 1% TDS (tax deducted at source), as it crypto index fund does when shopping for crypto within India. Shah states that such a cost won’t apply as a end result of no precise cryptocurrency is being bought. The Securities and Exchange Commission has approved eleven functions, including from BlackRock, Ark Investments/21Shares , Fidelity, Invesco and VanEck. Just like your mutual fund holdings you will not be investing immediately in Bitcoin via these ETFs, explains Shah.

Reportedly, Crypto Index Suppliers Typically Adhere To Transparent Methodologies

A cryptocurrency exchange-traded fund (ETF) is a pooled investment that tracks the value of cryptocurrencies using totally different strategies. Crypto ETFs provide cost-effectiveness, security, and hassle-free buying and selling. Crypto index funds shall be a believable reason for model new traders who’re skeptical. Yes, the business is still going to be risky and prone, and extremely dangerous.

Systematic Investment Plan(sip)

Here are a few of the best index funds pegged to the Nasdaq-100 index. Many, or all, of the merchandise featured on this web page are from our advertising companions who compensate us when you take certain actions on our web site or click on to take an motion on their web site.

Why This Etf Matters For Investors

As up to now, quite a few scandals have unfolded, and lots of have misplaced their funds either because of compromised wallets or sudden closures of firms. However, with ETFs now listed on tightly-regulated US stock exchanges, accessibility for retail traders could be facilitated via their present brokerage accounts. These accounts are subject to shut supervision, adding an extra layer of security to the investment course of. Crypto ETFs, particularly, have become a hot subject in the financial world.

First Belief Indxx Progressive Transaction & Process Etf

It additionally helps prevent traders from chasing overhyped developments. Index funds assist us make rational choices because they are based on a set of predetermined rules. BitSave offers the gateway to invest in one of many high crypto index i.e. the Bloomberg BGCI by way of a clear and secure route. Each constituent is proscribed to a most of weightage of 35% & minimal of 1% of the market cap.

Most underlying stocks in this fund are miners and investments in Coinbase and Microstrategy (the world’s largest Bitcoin holder publicly listed company). In truth, it invests in rising technologies, and cryptocurrency happens to be considered one of them. Rather, it invests in companies which are within the auxiliary cryptocurrency business.

Additional obstacles for people embrace sluggish wage growth, skyrocketing actual property prices and nationwide debt. While assets similar to Bitcoin, Ether and other cryptos emerged, they’ve endured a rollercoaster ride because of volatility and corporate mismanagement. A charge payable to a mutual fund home for managing your mutual fund investments. It is the total percentage of a company’s fund property used for administrative, management, advertising, and different bills. For instance, the unfold of false and deceptive details about a cryptocurrency can result in panic out there, and out of concern, you might dump your investments in that crypto with out doing due diligence. On the opposite, it may happen that a cryptocurrency may be hovering because of some speculative traders, and greed could result in you investing in it, too, with out checking for its fundamentals.

How Can Crypto Index Investing Profit The Investors?

In the fast-evolving realm of cryptocurrencies, where hundreds of digital property vie for attention, buyers face the daunting task of choosing where to allocate their funds. Fear of lacking out typically drives traders to explore new and promising cryptocurrencies, presenting both alternatives and challenges. In this panorama, crypto index funds emerge as a handy answer, offering exposure to a basket of digital assets through a single funding car. However, the rise of these funds raises questions on their compatibility with the elemental ethos of blockchain expertise. By bundling the two leading cryptocurrencies, the product permits traders to capitalize on the expansion of blockchain technology while mitigating risks by spreading publicity throughout both digital assets.

Theme-based investing entails investing in a particular sector in a diversified method. For example, the NFT & Metaverse Coin Set invests in cryptocurrencies which are constructing companies or products within the NFT & Metaverse area. By investing in this Coin Set, you get exposure to the NFT & Metaverse sector without having to analysis individual cryptocurrencies.

- However, the Bitcoin ETF doesn’t own cryptocurrencies immediately.

- Theme-based investing also allows you to leap onto the emerging trends of the crypto market with out all the time having to be on the lookout.

- A 1% tax could be deducted at supply for all transactions, as per Indian taxation legal guidelines.

- Below, we’re taking a glance at a few of the best index funds that track the S&P 500 and Nasdaq-100 indexes.

Conversely, if one of many stocks performs exceptionally nicely, the impression on the overall portfolio is also limited but nonetheless advantages from the overall market trend. This means, the investor just isn’t overly exposed to any one inventory and is as a substitute diversified throughout a broad vary of assets. For instance, let’s say an index fund tracks the S&P 500, and an investor has a goal asset allocation of 60% shares and 40% bonds.

This helps spread the danger across a number of investments and reduces the overall danger of the portfolio. The efforts to choose on a prime quality crypto index, present transparency and build trust is noteworthy. However, it’s prudent to keep away from over-exposure contemplating the evolving regulatory panorama within the nation. Well informed investors ought to consider to allocate not more than 3-5% of their overall portfolio in the direction of this asset class. The unstable & narrative pushed nature of the crypto property also demand a long-term approach mindset towards these investments. The Bitwise 10 crypto index fund invests within the prime 10 cryptocurrencies by market cap.

Analyzing the performance of individual crypto property and then allocating capital includes plenty of work. For now, the monetary world will be watching carefully as the SEC evaluates the Franklin Templeton Bitcoin & Ethereum Crypto Index ETF. Approval of the fund could mark a turning level in the integration of conventional finance and the cryptocurrency market, offering traders new tools to diversify their portfolios. The product is designed to attract a extensive range of investors who’re on the lookout for regulated and handy entry to the cryptocurrency market, while not having to purchase or store the belongings themselves. The ETF structure simplifies the process, making it simpler for conventional buyers to incorporate Bitcoin and Ethereum of their portfolios.

The Nifty 50 Index is managed by NSE (National inventory Exchange). NSE has predetermined criteria & rules to include and exclude the individual stocks within the index. Similar to the Nifty 50 index, Bloomberg, a worldwide financial software firm and Galaxy Digital Capital, a digital asset administration agency, launched the Bloomberg BGCI index in May 2018. The index is owned, administered by Bloomberg and co-branded with Galaxy Digital Capital Management.

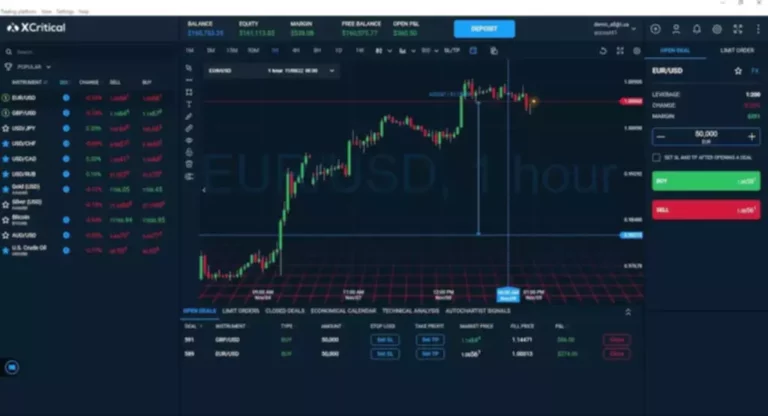

Read more about https://www.xcritical.in/ here.