If you want currency, borrowing from the bank against your house is going to be an easy way to rating it. You’ve got one or two an excellent choices to consider: a home security personal line of credit (HELOC), otherwise a money-out re-finance on the home loan. But when you are looking at an excellent HELOC compared to. cash-away refinance, which is the better option? Less than, we shall mention HELOC versus. cash-away re-finance options to make it easier to find the better financing option to you.

With good HELOC, your borrow on brand new guarantee you already have of your house. You have access to a credit line you can use against through the a predetermined date, which is labeled as your „draw several months.” That point is normally ten years. You never accrue interest on your own entire credit line at the once; you simply accrue desire toward number your obtain. Notice a good HELOC doesn’t require one sign a different sort of financial.

Having a money-aside refinance, you change your mortgage to own a different you to. One the brand new mortgage is for increased amount than the left mortgage balance. So, for many who already are obligated to pay $150,100 in your financial, you could potentially exchange they getting a $200,100000 home loan. If the fresh new financing shuts, you get an identify the extra matter (in such a case $fifty,000). Up coming, you make monthly mortgage payments to settle the new home loan.

Less than, we will shelter some more trick differences in the latest HELOC against. cash-out refinance domain. While you are shopping for dollars-aside refinancing, below are a few our book about precisely how refinancing really works.

Just how much you could potentially obtain

Throughout an earnings-out refinance, lenders fundamentally do not want the total amount of the new mortgage to help you exceed 80% of one’s house’s really worth. Having a good HELOC, certain loan providers allow you to supply ranging from 80-90% of one’s residence’s worthy of (without matter you already are obligated to pay on the financial).

Having an excellent HELOC, you could potentially borrow a tiny at once since you need they. You only need to shell out notice on the count your official site use, that help save you thousands finally. With a profit-away re-finance, you acquire the complete number at once — and you may immediately begin repaying interest into the complete contribution.

Credit score required

For these with a lower life expectancy credit rating, HELOCs is somewhat preferable over cash-away refinances. Are recognized to own an effective HELOC, you usually need a credit score out of 620 or even more. You could potentially qualify for a profit-out re-finance with a get only 640 — however you need a get as much as 700. If you’re not indeed there yet, you might strive to improve credit history.

The credit rating you prefer getting a money-out re-finance relies on two things. The level of collateral you really have of your house (how much of your own home loan you have reduced) is important. Concurrently, loan providers check your personal debt-to-income ratio — or how much you owe loan providers against. exactly how much you make.

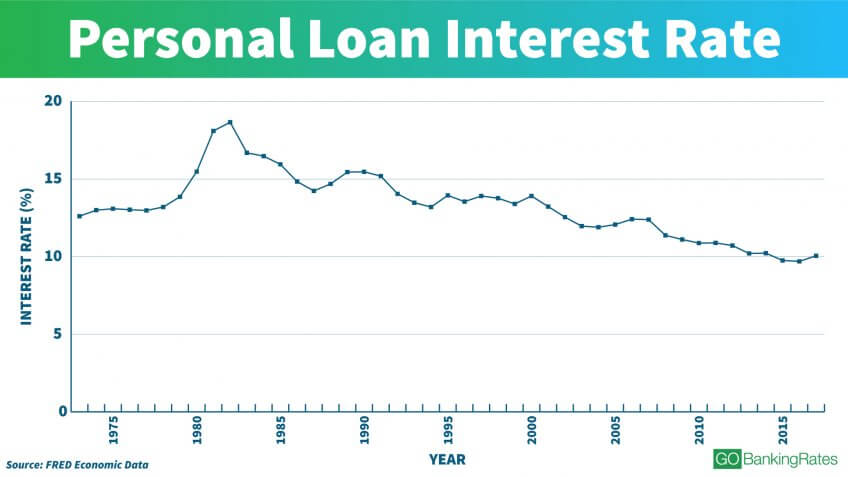

Rates

Rates for cash-aside refinances were less than rates to own HELOCs. Yet not, cash-out refinances has actually repaired rates — HELOC rates are often changeable. Once again, by using an excellent HELOC, you only pay appeal to the amount you’ve lent. When you get a cash-out re-finance, you pay interest to the full amount right away.

When deciding anywhere between a good HELOC versus. cash-aside refi, keep in mind that the pace you only pay for a cash-away refinance is only the interest rate you have to pay to your this new financial. And therefore speed relies on your credit rating, debt-to-income proportion, or other factors. Overseeing most recent re-finance pricing gives you a feeling of rate of interest you will get.