SoFi Signature loans

If you are a borrower with a good income and you may a credit rating of 680 or higher, a great SoFi unsecured loan will be a good choice. You would need to be actively functioning, performing a career within the next ninety days, or have an option supply of enough money getting qualified because of loan places Danielson it types of loan.

A stellar credit rating is actually an advantage, however, and make certain to read some SoFi personal bank loan evaluations so you can most readily useful get familiar into financial.

SoFi’s unsecured loans can be used for renovations, medical procedures, credit-credit combination, or another objective. As an effective SoFi user also offers almost every other experts we need to acknowledge: During these unstable moments, you can use the Unemployment Defense program for individuals who lose your job through no-fault of your.

For those who pertain promptly and have now laid off, SoFi suspends your monthly financing payments for a few weeks. This forbearance is prolonged in order to 12 months into the whole loan several months.

SoFi personal loans studies can tell you that team enjoys significant people-merely offers. Capable expect an excellent 0.125% rate of interest cures on a single extra SoFi equipment, provided it is a different type of mortgage; the brand new discount relates to both fixed and you can adjustable rates.

Users also access occupation coaching, where an individual advisor deals with that make certain you fulfill the elite goals, including offering guidance for creating your resume and learning learning to make their brand.

SoFi customers product reviews reveal that this one-on-one to method helps to make the people feel safe and causes an entirely most readily useful SoFi experience.

Other representative perk you might rating is one thing titled a recommendation Bonus: By the encouraging specific nearest and dearest to utilize SoFi, you can buy to $ten,100000 inside bonuses when they sign up.

Small-Business loans

- you are establishing business borrowing from the bank and maybe qualify for specific large financing later

- we want to change your business that have the latest devices

- you want to scale-up your company

- we would like to get more teams

Before you take this action, you will want to determine your following desires. SoFi critiques can help you consult previous consumers and examine desires and work out the decision convenient. It’s also advisable to make certain you can afford the financing commission, anything you want to buy getting.

Refinancing a mortgage

SoFi also offers several options to those individuals experiencing settling its home loan. The three preferred sorts of refinancing used for this was Refinance, Cash-away Refinance, and Student loan Cash-aside Re-finance.

There are also numerous date frames you might choose from getting repaying the financial age.grams., 30-12 months fixed, 20-season fixed, 15-seasons repaired, and 10-season repaired payments.

Judging from the SoFi home loan-refinance ratings therefore the webpages itself, the object all of these selection have in common is that you could have repaired money and you may a reliable interest from the whole payment several months. And when we would like to discover around simply how much those people do feel in advance of also doing the application form processes, SoFi’s calculator can do one to to you. To access they, you would need to generate a merchant account on SoFi, however you will never be forced to fool around with some of their functions when they dont match you.

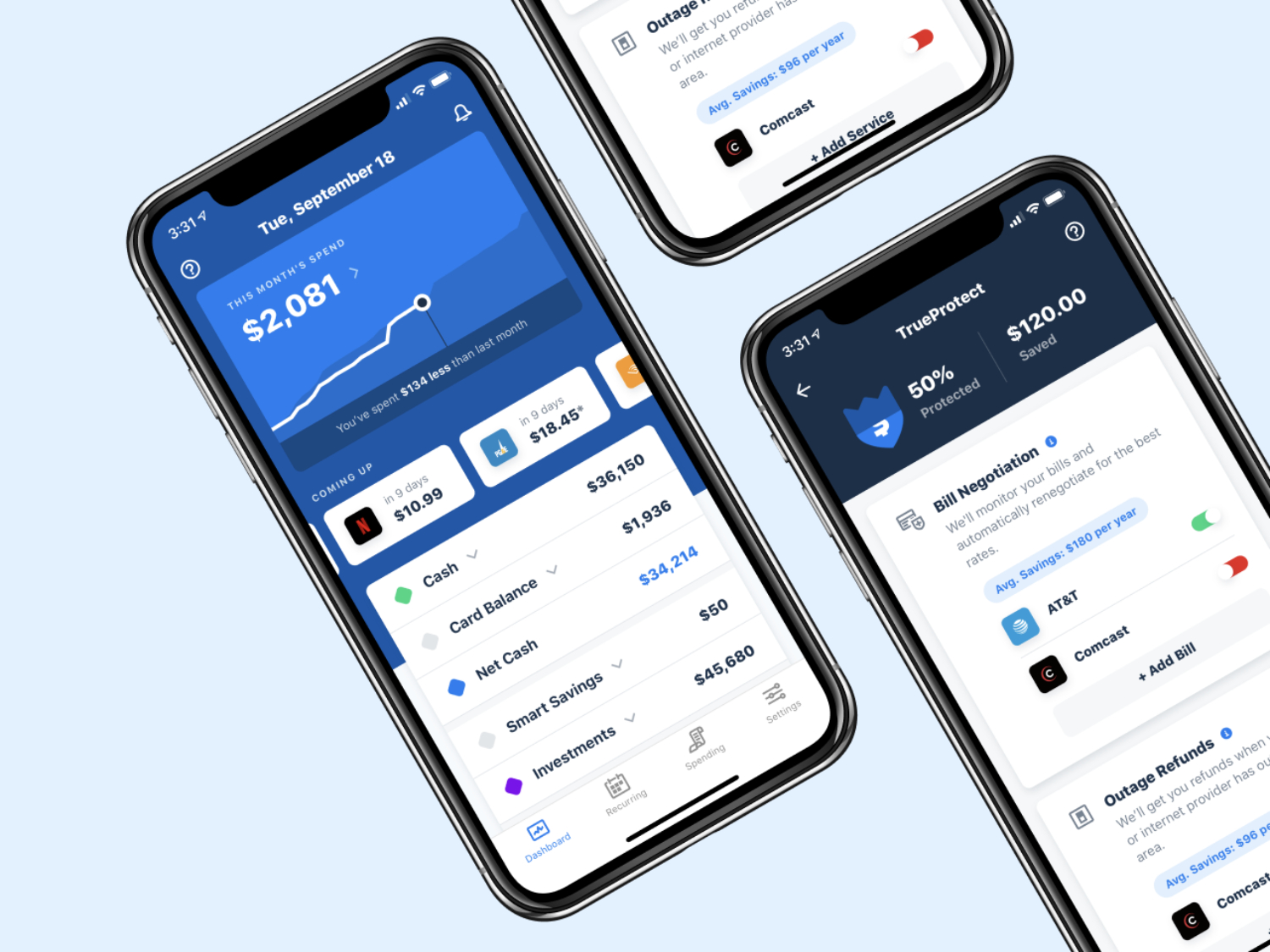

Sofi Purchase

SoFi paying product reviews will tell you this feature is actually a part of your SoFi app, and you can put it to use so you’re able to trading holds, cryptocurrencies, and ETFs. Its designed mostly first of all, nonetheless it works easily and provide your a complete insight into your account. Should you want to end deploying it, there aren’t any inactivity otherwise detachment charge.