Doc Lenders

Also referred to as a health care provider loan, this is not an ensured option for zero-down home loans, but it is worthy of examining while you are a health care professional, nursing assistant, otherwise health care employee. If you meet the requirements, you could find a no-to-low-down fee no PMI.

Zero-off financial choices are restricted. Nevertheless doesn’t mean you ought to cough upwards 20% down for your house buy. In reality, you will find countless lowest (think: between step 3 and you will 5%) down payment options.

FHA Loan

FHA funds could offer lower down fee selection plus much more casual borrowing standards, making this types of mortgage another choice way to homeownership.

Expert Tip

You’ll find thousands of advance payment guidance applications readily available, nonetheless they will vary centered on where you are. Browse a state and condition to see if your qualify.

FHA loans are specifically attractive to first-time homebuyers. Be told you will have to pay PMI using this type of alternative to the full home loan name. As well as, FHA money come with qualification conditions particularly the very least credit score away from 580, an obligations-to-income proportion less than 43%, loans Akron and you can proof of constant money.

HomeReady and you may Household You’ll be able to Mortgage loans

There are two different programs available to have earliest-big date homeowners particularly: HomeReady and you can Family It is possible to, claims James McCann, elderly loan administrator from the Progressive Lending People, a ca-centered home loan company. Household In a position can be acquired compliment of Fannie mae, while Household You’ll can be acquired through Freddie Mac.

HomeReady and you may Family You can is antique mortgage loans created specifically to own earliest-time people and will succeed step 3% down. In the place of regulators-supported finance such as for example Virtual assistant otherwise USDA mortgages, antique mortgage loans come from private lenders for example banking companies otherwise borrowing from the bank unions. Specific traditional financing should be supported by possibly Freddie Mac computer or Federal national mortgage association, a few organizations paid because of the authorities.

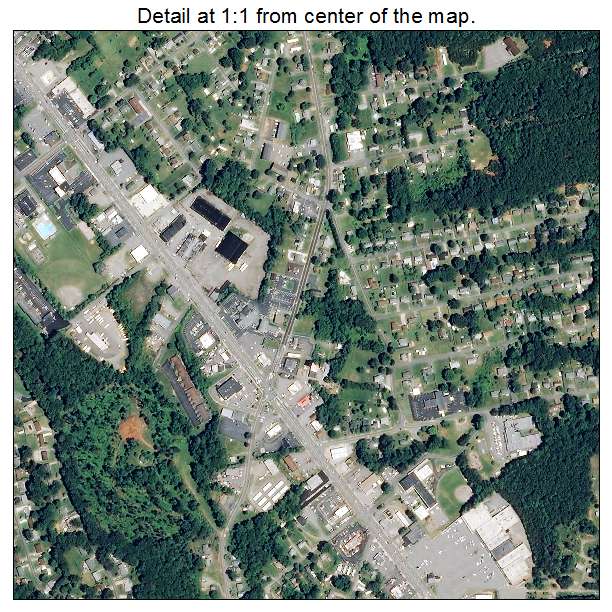

It’s still step three% off, nonetheless they make you a little bit of a break on an interest rate and you may, generally, towards individual financial insurance rates, McCann says. Both of these applications has an income restrict that’s target-certain. To find out while you are eligible for a beneficial HomeReady mortgage, make use of this map to get the income max close by. Family You can now offers a similar equipment.

Traditional 97 Financial

A conventional 97 financial is named because they security 97% of one’s house’s purchase price which have a decreased advance payment off only 3% off. They arrive by way of Freddie Mac computer or Federal national mortgage association. Recently up-to-date, the fresh new brand-new type of old-fashioned 97 mortgage loans can be found in order to very first-time homebuyers otherwise those who have not owned within the last 36 months.

With this particular choice, you will need to fool around with PMI that can keeps a top interest as compared to some of the other federally-recognized options, warns McCann. When you can get rid of PMI after you generate enough guarantee of your home.

Try PMI Worthwhile?

For individuals who lay a small advance payment (lower than 20%) to your a property purchase, you are able to usually feel caught investing PMI. If you’re PMI indeed escalates the price of homeownership, it does still be worth it for many individuals. But even though PMI will probably be worth they for you depends on the individual situation.

Owning a home, and you can making mortgage payments for the property you own rather than expenses lease, is a great way to generate money via your residence’s equity. And you can according to the brand of mortgage, the extra PMI prices won’t be long lasting. Very getting into a property at some point, is healthier fundamentally.

But owning a home boasts extreme upfront will set you back additionally the ongoing debts off keeping the home. After you reason behind the new charging out-of maintaining your home and you will spending PMI, buying may not be reduced monthly than simply leasing, according to where you live. Based on how secure your own revenue stream was, or how much time you plan to reside the home, racing to find may not be the best choice.